Bowermaster's Safety Video Library.

What's your Insurability Index™ You Have One

A Smart Insurance Buyer and Risk Manager understands this.

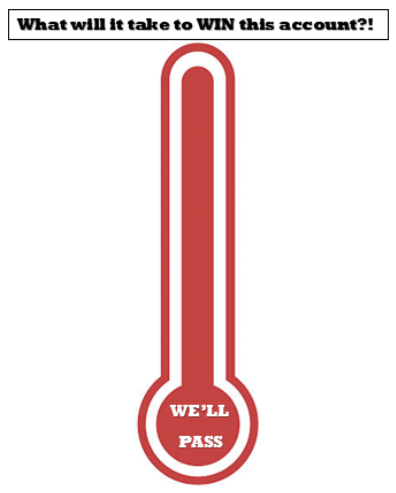

Just as your credit score is a reflection of you and impacted by decisions you make (high debts, late pay, run credit score a lot, too many credit cards, irresponsible, over leveraged; OR great pay, low debts, responsible with money), your Insurability Index is affected in the same way. While the Insurability Index is not an actual index, you absolutely have a reputation in the insurance industry based on your actions, decisions, and dealings with insurance agencies and carriers. And rest assured, your index (i.e. reputation) impacts your pricing and your ability to get insurance carriers to want to compete for your business. Underwriters often respond with "What will it take to win this account…we want it?!" or "Thanks but no thanks, we'll pass"; and somewhere in between. How do they respond to your account? How attractive are you to the insurance marketplace?

Just as your credit score is a reflection of you and impacted by decisions you make (high debts, late pay, run credit score a lot, too many credit cards, irresponsible, over leveraged; OR great pay, low debts, responsible with money), your Insurability Index is affected in the same way. While the Insurability Index is not an actual index, you absolutely have a reputation in the insurance industry based on your actions, decisions, and dealings with insurance agencies and carriers. And rest assured, your index (i.e. reputation) impacts your pricing and your ability to get insurance carriers to want to compete for your business. Underwriters often respond with "What will it take to win this account…we want it?!" or "Thanks but no thanks, we'll pass"; and somewhere in between. How do they respond to your account? How attractive are you to the insurance marketplace?

We recommend you Start a Conversation with a Bowermaster Certified Analytic Broker to learn how your Insurability Index can be improved, which will improve your bottom-line and Shrink the Iceberg!