Bowermaster's Safety Video Library.

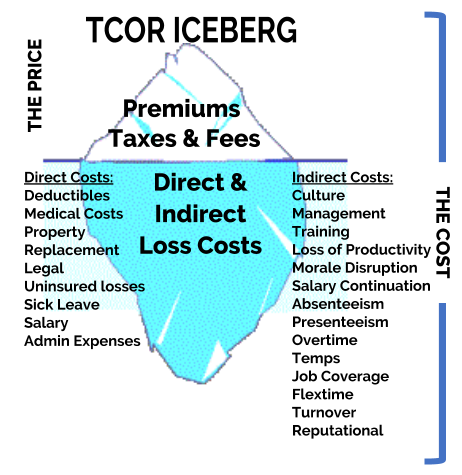

The Total Cost of Risk Iceberg

The Smart Insurance Buyer and Smart Risk Manager will focus on the Total Cost of Risk Iceberg

Most buyers of insurance focus on the premium. As if the premium is the total cost of their risk (TCOR). There may be short-term cost savings by focusing on the premium, but for long-term cost savings and real bottom-line impact, a smart buyer of insurance will focus on the whole Iceberg.The TCOR Iceberg is the appropriate analogy/imagery to portray a business owner’s true risk management and insurance costs (i.e. Total Cost of Risk). The Price (i.e. Premium) is one thing, but most of your costs lie beneath the water-line. If you don’t understand this and you don’t understand the Direct and Indirect Costs associated with your insurance and risk, then you are 100% not making smart decisions driven by knowledge and data. A good Trusted Insurance Advisor will work with their client to “Shrink the Iceberg” (i.e. your overall costs) through education, data and resources.

This will drive impactful results to your bottom-line when you consider insurance is a top three expense item for your business.

We recommend you Start a Conversation with a Bowermaster Certified Analytic Broker to learn what lies beneath your water-line, which causes financial leakage and can sink your ship. We can Shrink the Iceberg and increase your Insurability Index.